|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Archer-Daniels-Midland Stock Underperforming the Dow?

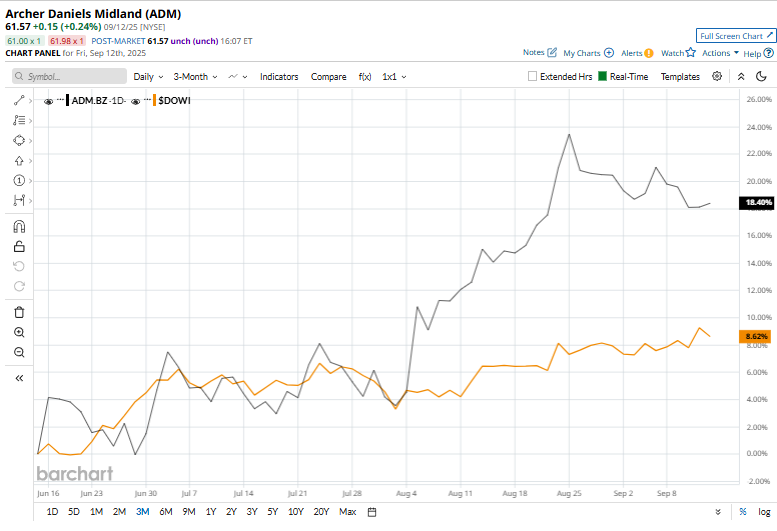

Valued at a market cap of $29.6 billion, Archer-Daniels-Midland Company (ADM) is a prominent food processing and commodities trading corporation headquartered in Chicago, Illinois. Founded in 1902, ADM is one of the world’s largest agricultural processors and nutrition providers, handling oilseeds, corn, wheat, cocoa, and other feedstocks. Companies worth more than $10 billion are generally labeled as “large-cap” stocks and Archer-Daniels-Midland fits this criterion perfectly. ADM operates an extensive global network of crop procurement, storage, transportation, and processing facilities, linking farmers with end-users around the world. Its customer base spans food and beverage companies, animal feed producers, energy firms, and the health and wellness industry. Despite this, shares of the food titan have declined 4.4% from its 52-week high of $64.38, met on Aug. 25. ADM stock has increased 24% over the past three months, significantly outpacing the broader Dow Jones Industrial Average’s ($DOWI) 6.7% rise during the same time frame.

In the longer term, ADM stock is down 21.9% on a YTD basis, underperforming $DOWI’s 7.7% gain. However, shares of the agribusiness giant have soared 3.3% over the past 52 weeks, compared to $DOWI’s 11.5% return over the same time frame. The stock has been trading above its 50-day moving average since mid-April and over its 200-day moving average since early June, indicating an uptrend.

On Aug. 5, Archer-Daniels-Midland released its second-quarter earnings and its shares popped 6% in the next trading session. Its revenue fell 5% year over year to $21.2 billion, and adjusted EPS came in at $0.93, down 10% year over year. However, both the topline and bottom line surpassed Street’s estimates. While Ag Services & Oilseeds and Carbohydrate Solutions faced pressure from lower volumes, weaker margins, and policy uncertainty, Nutrition provided modest growth, led by Animal Nutrition. Management trimmed full-year adjusted EPS guidance to around $4.00 and emphasized cost savings, operational efficiencies, and portfolio simplification In comparison, rival Bunge Global SA (BG) has dipped 15.4% over the past 52 weeks and is up 5% in 2025, trailing AMD’s gains over the same time frames. Nevertheless, the stock has a consensus rating of “Hold” from 11 analysts in coverage, and ADM currently trades above the mean price target of $57.67. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|