|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Monolithic Power Stock Underperforming the S&P 500?/Monolithic%20Power%20System%20Inc%20logo%20and%20stock%20chart-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

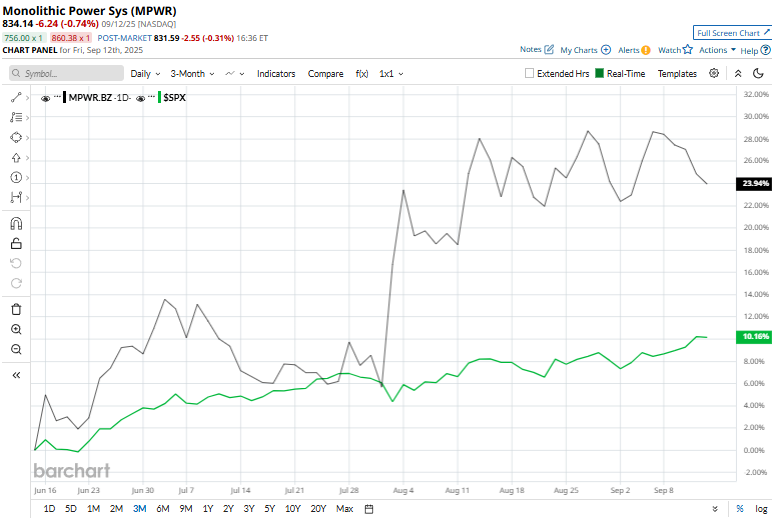

With a market cap of $39.9 billion, Monolithic Power Systems, Inc. (MPWR) is a fabless semiconductor company specializing in power management solutions, including DC-to-DC converters, AC-to-DC power supplies, LED drivers, and battery management ICs. The Kirkland, Washington-based company serves diverse markets, such as cloud computing, telecom infrastructure, industrial systems, automotive, and consumer electronics. Companies worth $10 billion or more are typically referred to as "large-cap stocks." MPWR fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the semiconductor industry. MPWR is recognized for its innovative, energy-efficient designs that integrate multiple power components into a single chip, thereby enhancing performance and reducing system size. The company has demonstrated substantial revenue and earnings growth in recent years, driven by rising demand in AI, data infrastructure, and other high-performance computing applications. Despite its strengths, the stock has plunged 12.6% from its 52-week high of $954 touched on Oct. 14, last year. Moreover, over the past three months, MPWR stock has surged 16.1%, outperforming the S&P 500 Index ($SPX), which has returned 8.9% over the same time frame.  MPWR shares have surged 41% year-to-date, significantly outpacing the S&P 500’s 12% gain in 2025. Over the past 52 weeks, however, the stock has declined 6.9%, lagging the index’s 17.7% advance. Technical indicators suggest an uptrend, with MPWR trading above its 50-day moving average since late April and above its 200-day moving average since early June.  On Jul. 31, shares of Monolithic Power Systems skyrocketed 10.5% after the release of its Q2 2025 results, reflecting strong investor confidence in the company’s performance and outlook. Its adjusted EPS of $4.21 and revenue of $664.6 million topped Wall Street’s expectations. This robust quarterly performance was complemented by forward-looking guidance, with management projecting Q3 revenue between $710 million and $730 million, signaling continued acceleration into the second half of the year. The impressive results are driven by MPS’s critical role in the AI hardware ecosystem, where modern data centers face unprecedented power demands from high-performance AI accelerators like GPUs and custom ASICs. In the semiconductor arena, rival NXP Semiconductors N.V. (NXPI) has grown 5.3% in 2025, underperforming the MPWR. Among the 16 analysts covering the MPWR stock, the consensus rating is a “Moderate Buy.” Its mean price target of $844.33 suggests a modest 1.2% upside potential from current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|